Notice regarding revisions to the restricted stock compensation plan

Company name: SUBARU CORPORATION

Representative: Atsushi Osaki, Representative Director, President and CEO

Code number: 7270 (Tokyo Stock Exchange Prime Market)

Contact for inquiries: Yasushi Nagae, Vice President

and General Manager of Investor Relations Department

Phone: +81-3-6447-8825

Subaru Corporation (hereinafter referred to as the “Company”) hereby announces that its Board of Directors, at the meeting held today, resolved to revise its restricted stock compensation plan (hereinafter referred to as the “Plan”) as part of its efforts to review the executive compensation plan. The Company plans to present a proposal on the revisions to the Plan at the 93rd Ordinary General Meeting of Shareholders to be held in June 2024 (hereinafter referred to as the “General Meeting”).

Details of the revisions are provided below.

1. Purpose of the revisions to the Plan

The revisions to the Plan are intended to provide a greater incentive for Company directors and executive officers, other than Outside Directors (hereinafter collectively referred to as the “Directors and Officers”) to achieve sustained improvement of the Subaru Group’s value over the mid- and long-term.

The revisions to the Plan are subject to approval by the shareholders at the General Meeting.

2. Overview of the revisions to the Plan

(1) Raising the ratio of stock compensation to total compensation

The Company introduced restricted stock compensation (RS type) to the executive compensation plan in fiscal 2017 with a view towards incentivizing Directors and Officers to achieve sustained improvement of the Company’s value over the mid- and long-term and to share more of that value with shareholders. In fiscal 2022, the Company added a performance share unit (PSU type) in a bid to raise the ratio of stock compensation in stages.

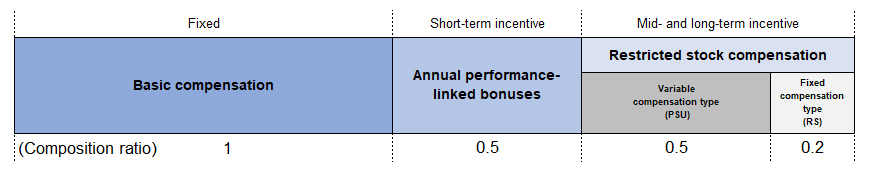

These revisions are intended to further raise the ratio of stock compensation and link enhancement of the Company’s corporate value more closely to compensation. The basic composition ratios of compensation among basic compensation, annual performance-linked bonuses, and restricted stock compensation of the Representative Director of the Board, President and CEO will be 1:0.5:0.7 (0.5 in PSU + 0.2 in RS).

Compensation of Outside Directors remains unchanged and consists solely of basic compensation.

(2) Addition of a key performance indicators (KPI) to PSU

As KPIs for the PSU portion of the Plan, in fiscal 2022, the Company adopted consolidated ROE and employee engagement (employee satisfaction rating) for quantitative (financial) evaluation and qualitative (non-financial) evaluation, respectively, in a bid to achieve the priority initiatives laid out in the Subaru Group’s mid- and long-term strategies.

On this occasion, the Company has added relative total shareholder return (TSR) (vs. dividend-included TOPIX growth rate) which represents improvement of corporate value as a KPI for quantitative (financial) evaluation

(3) Introduction of provisions

To enhance governance over compensation, the Company is taking this opportunity of raising the ratio of stock compensation to introduce clawback provisions to the Plan. If an executive is found to be involved in any misconduct or a serious error is found in performance results based on which stock was granted during the period when the transfer is restricted or within three years after the restriction is lifted, the Company shall, pursuant to a resolution at its Board of Directors, based on the deliberations and decisions made at the Executive Compensation Meeting, be entitled to all or part of stock thus awarded for free or demand that said executive pay monies equivalent to the value of such stock.

Composition of compensation of the Representative Director of the Board, President and CEO

###